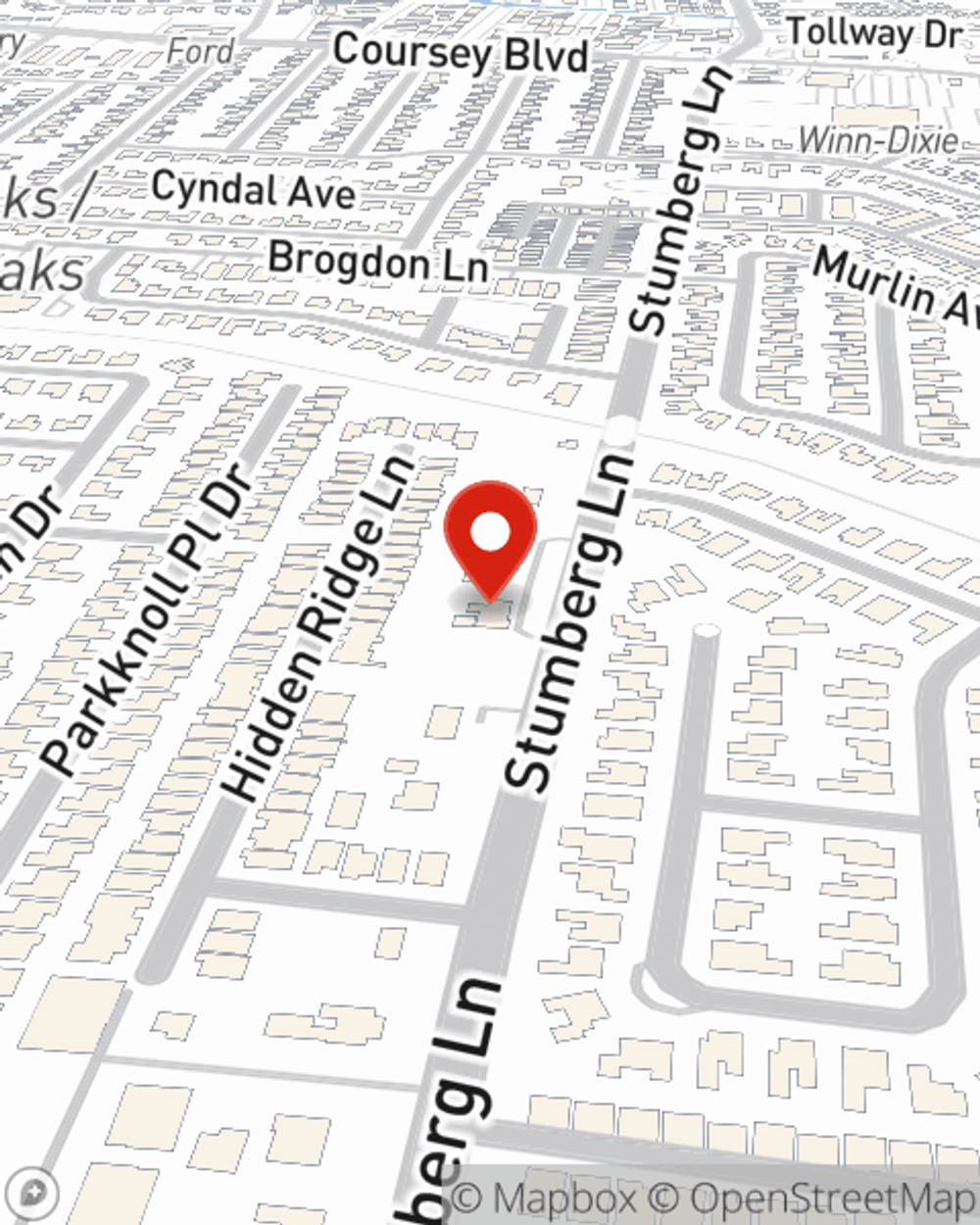

Life Insurance in and around Baton Rouge

Life goes on. State Farm can help cover it

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

- Baton Rouge

- Louisiana

- Denham Springs

- Livingston Parish

- E Baton Rouge Parish

- W Baton Rouge Parish

- Ascension Parish

- Prairieville La

- Gonzales LA

- Zachary LA

- Walker LA

- Port Hudson

- French Settlement

Protect Those You Love Most

There's a common misconception that Life insurance is only needed when you become a senior, but even if you are young and just rented your first place, now could be the right time to start learning about Life insurance.

Life goes on. State Farm can help cover it

Don't delay your search for Life insurance

Agent Greg Archer, At Your Service

Life can be just as unexpected when you're young as when you get older. That's why there's no time like the present to get Life insurance and why State Farm offers a couple of different coverage options. Whether you're looking for level or flexible payments with coverage to last a lifetime or coverage for a specific time frame, State Farm can help you choose the right policy for you.

As a dependable provider of life insurance in Baton Rouge, LA, State Farm is committed to be there for you and your loved ones. Call State Farm agent Greg Archer today and see how you can save.

Have More Questions About Life Insurance?

Call Greg at (225) 752-5217 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Greg Archer

State Farm® Insurance AgentSimple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.